Make sure your deposit information is correct, then select Deposit. You’ll get an on-screen confirmation and an email letting you know we’ve received your deposit. After your deposit, write “mobile deposit” and the date on the front of the check. You should keep the check secure for 5 days before tearing it up. Check 21 Processing. Your Check 21 funds are deposited into your existing bank account. Next-day funds availability. Check 21 allows banks and credit unions to share both deposit data and check images known as 'Image Replacement Documents'. Check 21 is not subject to ACH (Automated Clearing House) rules, therefore transactions are not subject to NACHA (The Electronic Payments Association.

- Cash App Mobile Check Deposit

- Deposit Check Online Chase

- Deposit Check Online Capital One

- Deposit Check Online

- Deposit Check Online Regions

How mobile deposit works

Explore these simple steps to deposit checks in minutes.

1. Download the Wells Fargo Mobile app to your smartphone or tablet.

2. Sign on to your account.

3. Select Deposit in the bottom bar. Or, use the Deposit Checks shortcut.

For any check amount from $25 to $100, a $2 fee will apply to each check. If the check is returned due to insufficient funds, PNC will not debit your account. If your deposit is completed before 10 p.m. ET on a business day, your funds will also be available to pay checks or items during nightly processing. For example, if you deposit a $2,500 check through Mobile Deposits on Monday and receive deposit approval before 6 pm, ET on Monday, $225 of the deposit will be available that day for cash withdrawal only. The remaining $2,275 will be available on Wednesday (2 business days after the approval).

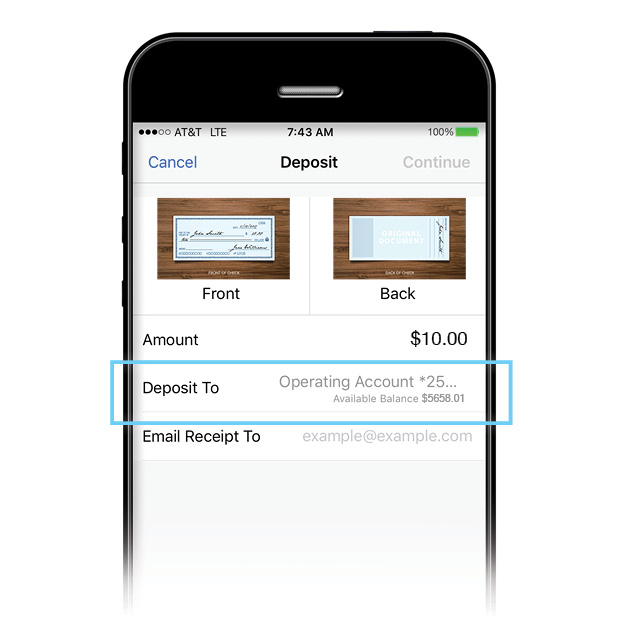

1. Select an account from the Deposit to dropdown. If you have set up a default account, it will already be pre-selected.

Cash App Mobile Check Deposit

2. If you want to create or change your default account, go to the Deposit to dropdown and select the account you want to make your default, then select Make this account my default.

1. Enter the check amount. Your account’s remaining daily and 30-day mobile deposit limit will also display on the screen.

2. Make sure the amount entered matches the amount on your check, and select Continue.

1. Sign the back of your check and write “For Mobile Deposit at Wells Fargo Bank Only” below your signature (or if available, check the box that reads: “Check here if mobile deposit”).

2. Take a photo of the front and back of your endorsed check. You can use the camera button to take the photo. For best results, use these photo tips:

• Place check on a dark-colored, plain surface that’s well lit.

• Position camera directly over the check (not angled).

• Fit all 4 corners inside the guides on your mobile device’s screen.

1. Make sure your deposit information is correct, then select Deposit.

2. You’ll get an on-screen confirmation and an email letting you know we’ve received your deposit.

3. After your deposit, write “mobile deposit” and the date on the front of the check. You should keep the check secure for 5 days before tearing it up.

Still have questions?

Quick Help

Deposit Check Online Chase

Call Us

Find a Location

Mobile deposit is only available through the Wells Fargo Mobile® app. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s Online Access Agreement for other terms, conditions, and limitations.

LRC-0620

Ingo Money is a service provided by First Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions https://www.ingomoney.com/terms-conditions/general-sdk/ and Privacy Policy https://www.ingomoney.com/privacy-policy Approval review usually takes 3-5 minutes, but may take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Unapproved checks will not be loaded to your card. Ingo Money reserves the right to recover funds from bad checks if you knew the check was bad when you submitted it, if you attempt to cash or deposit it elsewhere after funding or if you otherwise act illegally or fraudulently. Fees may apply for loading or use of your card. See your Cardholder Agreement for details. Fees and other terms and conditions apply to check load services.

Deposit Check Online Capital One

Neither Green Dot account, Green Dot Bank, Green Dot Corporation, Visa U.S.A. or any of their respective affiliates provide or are responsible for Ingo Money Products or Services.

Deposit Check Online

App Store is a service mark of Apple Inc. Google Play is a trademark of Google Inc.

Deposit Check Online Regions

© 2020 Ingo Money, Inc. All rights reserved.