Please turn on JavaScript in your browser

Chase Check Deposit

Here’s how: Sign in to your account Choose 'Collect & deposit', then choose 'Deposit Checks' Enter deposit details, then load check (s) into the scanner Wait for the scanner indicator light, then choose.

- OR a linked Chase Better Banking ® Checking, Chase Premier Checking℠, Chase Premier Plus Checking℠, Chase Sapphire℠ Checking, or Chase Private Client Checking℠ account Savings Withdrawal Limit Fee: $5 Savings Withdrawal Limit Fee, which is a Chase fee, applies to each withdrawal or transfer out of this account over six per monthly.

- Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly.

- Make an electronic transfer. You can easily transfer money into a friend’s or relative’s account.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

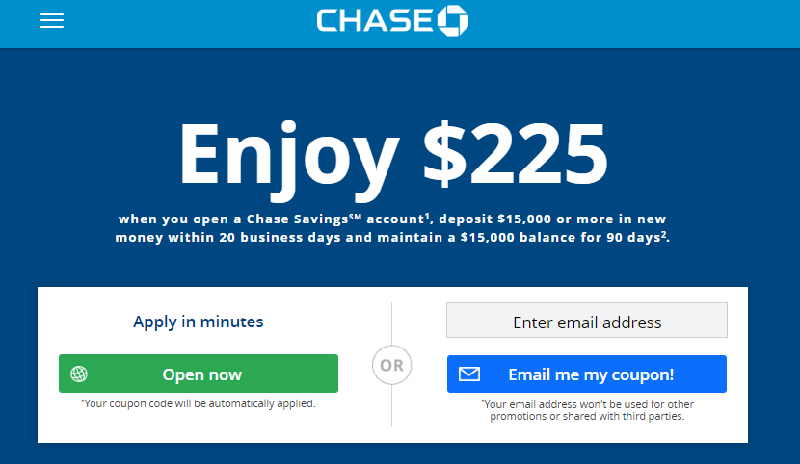

Savings made simple with Chase Savings℠

This account makes it easy to start saving. You’ll have access to chase.com and our mobile banking tools.

Benefits of Chase Savings℠

- Earns interest. See interest rates.

- Automatic Savings Program

- Online and mobile banking

- Account Alerts

- Access to 16,000 ATMs and more than 4,700 branches

- FDIC insurance protection

Account details include:

Chase Check Deposit Availability

- $5 monthly service fee or $0 with one of the following, each monthly statement period:

- A balance at the beginning of each day of $300 or more in this account

- OR $25 or more in total Autosave or other repeating automatic transfers from your personal Chase checking account (available only through chase.com or Chase Mobile®)

- OR a Chase College Checking℠ account linked to this account for Overdraft Protection

- OR an account owner who is an individual younger than 18

- OR a linked Chase Better Banking® Checking, Chase Premier Checking℠, Chase Premier Plus Checking℠, Chase Sapphire℠ Checking, or Chase Private Client Checking℠ account

Savings Withdrawal Limit Fee: $5 Savings Withdrawal Limit Fee, which is a Chase fee, applies to each withdrawal or transfer out of this account over six per monthly statement period. All withdrawals and transfers out of this account count toward this fee, including those made at a branch or at an ATM.

Other miscellaneous fees apply.

See Account Disclosures and Rates for more information. Account subject to approval.

BeginningTools to help you bank on your terms.

Direct Deposit

Most convenient way to automatically deposit your checks each payday.

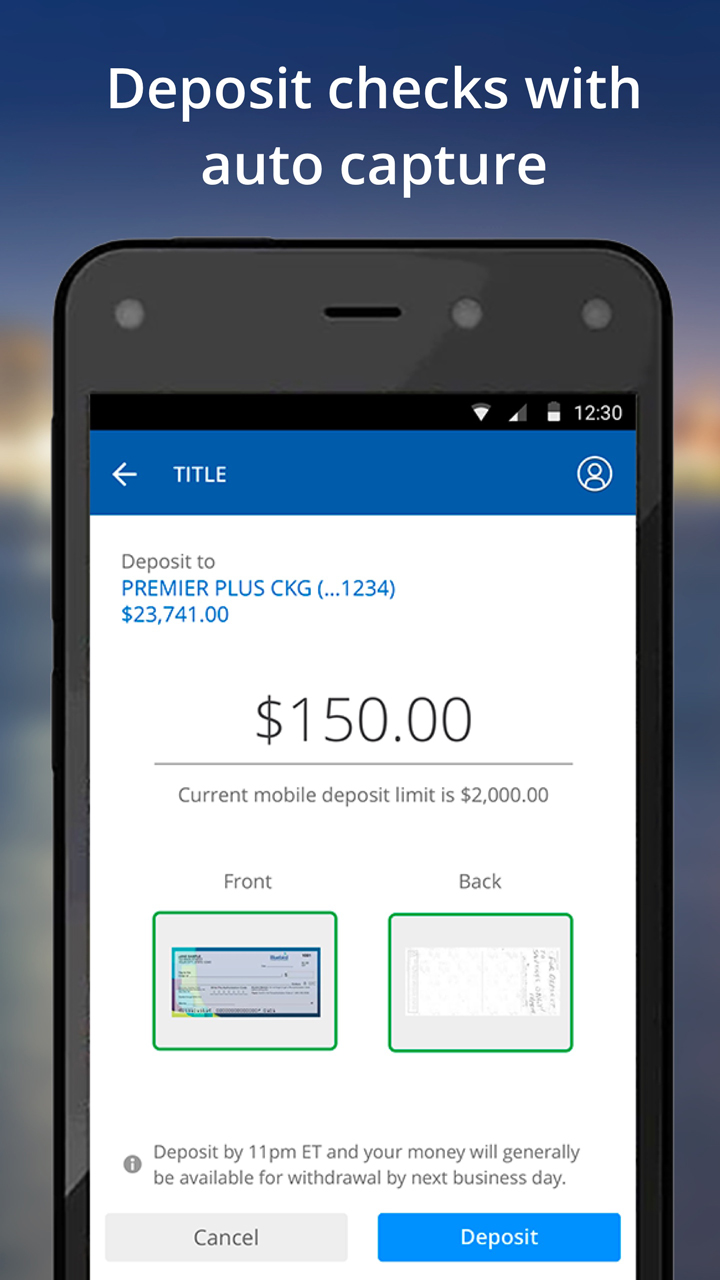

Chase QuickDeposit℠

Just point and click to deposit checks from almost anywhere, anytime.

Online Bill Pay

Make payments securely at chase.com or with your mobile device.

Chase QuickPay® with Zelle®

Easily send money to another person without cash or checks.

Paperless Statements

Access up to 7 years of statements online or on your mobile device.

Account Alerts

Monitor your finances to help avoid overdrafts and safeguard your account.

Text Banking

Check balances and transaction history on the go by simply sending a text.

EndFind the right savings account for you

- Chase Certificates of Deposit

- Chase Premier Savings℠

Chase Check Deposit Hold

Find a Chase ATM or branch

Chase Check Deposit Days

To find a Chase ATM or branch near you, tell us a ZIP code or an address.

Chase Check Deposit Fee

Additional assistance

- See exclusive Chase Private Client products

- Learn about Chase Military Banking for servicemembers